I’ve been asked to contribute to a book about smart cities and finance. I looked over the long list of tentative chapter titles provided by the publisher and it’s clearly meant to be an optimistic pragmatic problem solver. There’s an expectation that everything that ails our cities and towns can be fixed with the right combination of technology and creative accounting. I’m hashing out my thoughts here to clarify my position. We’ll see if the invitation sticks.

I’ll begin by stating the obvious. Technology has already transformed society in significant ways and will continue to do so at an accelerating pace. But we need to be clear about what tech is and what it isn’t. All our computerized bells and whistles are tertiary layers of organization that are superimposed over the existing underlying primary structures of society. Tech isn’t food. It’s not fuel. Tech isn’t manufacturing per se. It’s not a new means of moving anything from point A to point B. Tech may optimize these things, but all our sophisticated interconnected devices and algorithms are themselves dependent on lower level physical extraction, production, and distribution. And all this complexity has a metabolic cost above and beyond what was previously required.

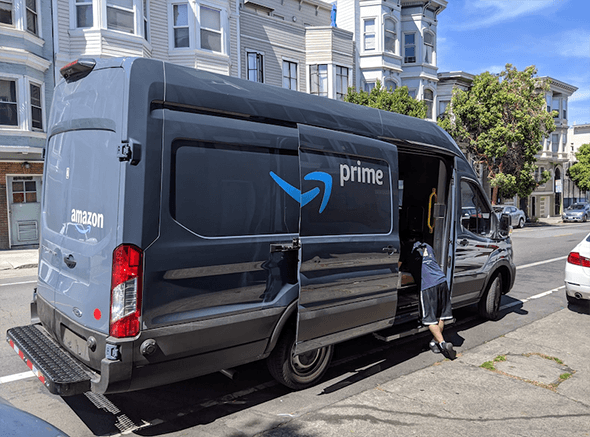

A Tesla is a slick incremental refinement of a Model T Ford from a century ago. Google is an advertising company with a side hustle as a reference library. Facebook is a low grade tabloid newspaper. “Senator, we run ads.” Amazon is merely the latest version of the mail order Sears Catalog circa 1897. Apple makes whiz bang versions of telegraphs, televisions, cameras, telephones, typewriters, radios, and wrist watches. They’re cool, but not fundamentally different from their less exotic analog forebears. Big Data is a more advanced version of cuneiform tables and their administrators are an updated rendering of palace high priests. Digital information will prove far less durable over time than clay tablets because it’s ephemeral by design. This isn’t a criticism of technology, just a clarification of reality in case anyone has drifted too far away.

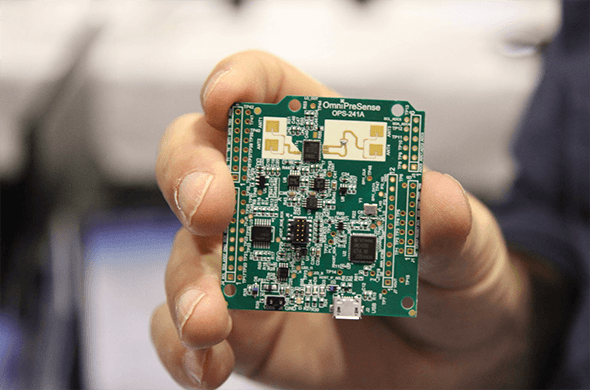

The twentieth century concept of money was a collective fiction that pieces of colored paper have durable value. In God We Trust. The new common experience involves invisible digits suspended in the electronic ether. Even little plastic cards are giving way to cell phone transmissions, RFID tags, and contactless transactions of all kinds. Crypto currencies and block chain are all the rage these days. The abstraction of money has itself become further abstracted and endowed with the illusion of worth. Quantitative easing, zero interest rates, negative interest, stimulus… Money is the lubricant of society, but it is not itself real. Cut off the power supply for a week and see how long these things last.

Read the rest of this piece on Granola Shotgun.

Johnny Sanphillippo is an amateur architecture buff with a passionate interest in where and how we all live and occupy the landscape, from small rural towns to skyscrapers and everything in between. He travels often, conducts interviews with people of interest, and gathers photos and video of places worth talking about (which he often shares on Strong Towns). Johnny writes for Strong Towns, and his blog, Granola Shotgun.