Rentcafe.com has just published a list of the 51 ZIP Codes in the United States that have had the most apartment construction over the last five years (2018-2022). These neighborhoods are located in 20 metropolitan areas (which are housing and labor markets). This article provides data from Rentcafe.com for each of these metropolitan areas, the urban core versus suburban distribution of the new apartment zip codes, as well as recent building permit data for multi-family and single-family housing for the first 8 months of 2023 annualized.

Dallas-Fort Worth, TX a metropolitan area known for its broad expanse of single-family housing, lead the list with 30,557 new apartments. Dallas-Fort Worth had the most zip codes among the top 51, with eight. Two of the zip codes were in or near the urban core, while six were in the suburbs (Farmers Branch, Richardson, McKinney, Frisco, Grand Prairie and The Colony). About 80% of the new apartments are in the suburbs. In 2023 (through August), Dallas-Fort Worth ranked 2nd nationally in multi-family permits and 2nd in single-family permits.

Second place was taken by the Washington, DC-VA-MD-WC metropolitan area with 17,613 new apartments. Washington included the two zip codes with the largest number of new apartments, which are located near the Capitol. A third zip code is in Alexandria, Virginia. In 2023 (through August), Washington ranked 9th nationally in multi-family permits and 15th in single-family permits.

Austin, Texas, the fastest growing metropolitan area in many recent years, added 17,479 new apartments, for third place. Five zip codes are ranked in the top 51. Three are located in or near Austin’s urban core, while two are in the suburbs (San Marcos and Pflugerville). In 2023 (through August), Austin ranked 3rd nationally in multi-family permits and 7th in single-family permits.

New York, NY-NJ-PA, which has by far the largest number of apartments in the nation, ranked fourth with 15,174. This included three zip codes, two in New York City (Brooklyn and Queens) and one in Exchange Place, which has become an across-the-Hudson extension of New York City’s Lower Manhattan and also includes downtown Jersey City. None of the zip codes was in the urban core of Manhattan. In 2023 (through August), New York ranked 1st nationally in multi-family permits and 11th in single-family permits.

Chicago, IL-IN-WI ranked fifth with 13,713 new apartments. This includes four zip codes, which virtually surround the Chicago’s Loop (the central business district), on the south, west and north sides. In 2023 (through August), Chicago ranked 25th nationally in multi-family permits and 22nd in single-family permits.

Seattle ranked sixth, adding 13,016 apartments in three zip codes. One is in suburban Redmond (headquarters of Microsoft), with two more in Belltown and Lake Union-Queen Ann near the urban core. In 2023 (through August), Seattle ranked 13th nationally in multi-family permits and 29th in single-family permits.

Atlanta ranked seventh with 12,174 new apartments in three zip codes in the city of Atlanta. In 2023 (through August), Atlanta ranked 7th nationally in multi-family permits and 4th in single-family permits.

Miami ranked eighth, adding 11,989 apartments, two in Miami zip codes and one in Fort Lauderdale. In 2023 (through August), Miami ranked 5th nationally in multi-family permits and 37th in single-family permits.

Houston ranked ninth and added 11,558 in three urban core zip codes. In 2023 (through August), Houston ranked 4th nationally in multi-family permits and 1st in single-family permits.

Phoenix ranked 10th, adding 9,254 apartments, one in a city of Phoenix zip code and the other in a suburban Tempe zip code. In 2023 (through August), Phoenix ranked 8th nationally in multi-family permits and 3rd in single-family permits.

The San Francisco metropolitan area ranked 11th, adding 8567 apartments, in one San Francisco and one Oakland zip code. In 2023 (through August), San Francisco ranked 36th nationally in multi-family permits and 65th in single-family permits.

Denver ranked 12th, adding 7038 new apartments, two in urban core zip codes. In 2023 (through August), Denver ranked 11th nationally in multi-family permits and 21st in single-family permits.

Nashville ranked 13th, adding 6806 new apartments in a single urban core zip code. In 2023 (through August), Nashville ranked 10th nationally in multi-family permits and 8th in single-family permits.

Columbus ranked 14th, adding 6605 new apartments in one urban core zip code and a zip code on the outskirts of the city of Columbus. In 2023 (through August), Columbus ranked 24th nationally in multi-family permits and 38th in single-family permits.

Charlotte, NC-SC ranked 15th, adding 6363 new apartments, one zip code in the central business district and one in a more distant zip code within the city of Charlotte. In 2023 (through August), Charlotte ranked 16th nationally in multi-family permits and 5th in single-family permits.

San Diego ranked 16th, adding 5346 apartments, all in a central business district zip code. In 2023 (through August), San Diego ranked 22nd nationally in multi-family permits and 77th in single-family permits.

Tampa – St. Petersburg ranked 17th, adding 3379 apartments in a central business district zip code. In 2023 (through August), Tampa-St. Petersburg ranked 14th nationally in multi-family permits and 9th in single-family permits.

Jacksonville ranked 18th and added 3243 new apartments in a zip code on the outskirts of the city of Jacksonville. In 2023 (through August), Jacksonville ranked 18th nationally in multi-family permits and 13th in single-family permits.

Los Angeles ranked 19th, adding 3138 new apartments, in a Hollywood district zip code in the city of Los Angeles. In 2023 (through August), Los Angeles ranked 6th nationally in multi-family permits and 10th in single-family permits.

Orlando ranked 20th, adding 2806 new apartments in the central business district zip code. In 2023 (through August), Orlando ranked 15th nationally in multi-family permits and 6th in single-family permits.

State Analysis

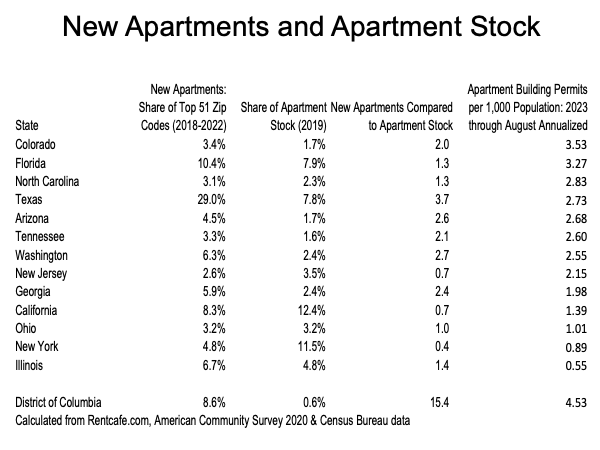

Texas led the nation among the top 51 new apartment zip codes, capturing 3.7 times its share relative to the 2019 (used as the midpoint year, because there was no apartment stock data in 2020) national apartment stock, according to ACS data (Figure). Three other states exceeded a ratio of 2.0 (Washington, Arizona, Georgia and Tennessee) and four other states exceeded a ratio of 1.0 (Colorado, Illinois, North Carolina, Florida and Ohio). Three states had ratios less than 1.00, New York and New Jersey, with all zip codes in the New York metropolitan area and California. California has fallen into population decline in the last few years, though state officials indicate that there is a 3.5 million deficit in housing units.

The District of Columbia, which is a single city as opposed to a metropolitan area, added apartments at a rate equal to more than 15 times its stock of apartments.

Among the 13 states with the top 51 new apartment Zip Codes reported by Rentcafe.com, Colorado had the largest number of apartment building permits as reported by the Census Bureau through in 2023 (through August), annualized, at 3.53 per 1,000 population. Florida was second at 3.27, followed by North Carolina at 2,83, Texas at 2.73, Georgia at 2.68, Tennessee at 2.60, Washington at 2.55 and New Jersey at 2.15. California had 1.39 apartment building permits per 1,000 population, followed by 1.01 in Ohio, 0.89 in New York and 0.55 in Ohio.

Among the three largest states (all with more than 20 million residents), Florida and Texas have had nearly double or more the apartment building permits per 1,000 population than California in 2023, despite the fact that public policy is heavily biased toward multi-family construction and against single-family housing construction, which the overwhelming majority of households prefer.

The District of Columbia had 4.53 apartment permits per 1,000 population through August of 2023.

Wendell Cox is principal of Demographia, an international public policy firm located in the St. Louis metropolitan area. He is a founding senior fellow at the Urban Reform Institute, Houston, a Senior Fellow with the Frontier Centre for Public Policy in Winnipeg and a member of the Advisory Board of the Center for Demographics and Policy at Chapman University in Orange, California. He has served as a visiting professor at the Conservatoire National des Arts et Metiers in Paris. His principal interests are economics, poverty alleviation, demographics, urban policy and transport. He is co-author of the annual Demographia International Housing Affordability Survey and author of Demographia World Urban Areas.

Mayor Tom Bradley appointed him to three terms on the Los Angeles County Transportation Commission (1977-1985) and Speaker of the House Newt Gingrich appointed him to the Amtrak Reform Council, to complete the unexpired term of New Jersey Governor Christine Todd Whitman (1999-2002). He is author of War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life and Toward More Prosperous Cities: A Framing Essay on Urban Areas, Transport, Planning and the Dimensions of Sustainability.

Photo: Downtown Dallas by Michael Barera via Wikimedia under CC 2.0 License.