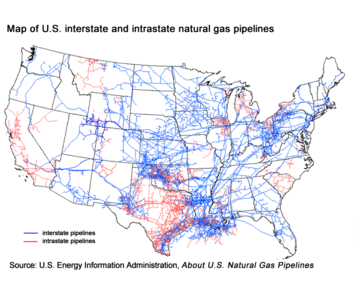

In the early 1990s, Ken Lay and his colleagues at Houston-based Enron, were, as one veteran of the energy business told me, “the kings of the American pipeline business.” Enron owned valuable pipelines across the US, and it moved or sold about 17% of all the natural gas consumed in the country.

But Lay and his top lieutenant, former McKinsey consultant Jeff Skilling, didn’t believe in pipelines. As I explain in my 2002 book Pipe Dreams: Greed, Ego, and the Death of Enron:

Skilling’s brain was too big for pipelines...The only thing that mattered to Skilling about Enron’s pipelines was that they kept providing him with cash that he could use elsewhere. For Skilling, elsewhere meant only one place: the trading business.

Lay and Skilling were sure they could go “asset light” and turn Enron into a trading powerhouse. To help fund that effort, they began selling the company’s pipelines. One of the buyers was Lay’s former second-in-command, Rich Kinder. In 1996, after Lay reneged on an agreement to make him the CEO of Enron, Kinder quit the company. Kinder told another Enron executive that he had no choice. “If you aren’t the lead dog,” he said, “the scenery never changes.”

In early 1997, Kinder and a colleague, Bill Morgan, bought a natural gas liquids pipeline from Enron for $40 million. It was an asset that Enron had determined wasn’t profitable enough to keep. The two men parlayed that bet, and many others, into a pipeline colossus called Kinder Morgan, which now has a market capitalization of $56 billion. Kinder, a lawyer by training, is the company’s largest shareholder. Forbes estimates his net worth is $10.4 billion, and thanks to Kinder Morgan’s annual payout of about $1.16 per share, his income from dividends alone likely exceeds $250 million per year.

Enron filed for Chapter 11 bankruptcy on December 2, 2001. At that time, it was the biggest bankruptcy in US history. The legacy of Enron is still reverberating in the US energy and power sectors. Given the tumult of the last few weeks, and in particular, the losses that happened last week in global equity markets, it may be profitable for investors to consider the lessons that can be learned from Enron’s demise and Kinder’s success. As I noted in Pipe Dreams:

The pipeline business is more akin to the utility business than the energy business. Pipelines carry a product from one spot to another and the owner of the pipe gets paid a fee for the service. It’s a straightforward, profitable business. As one former Houston Natural Gas executive said of pipelines, “All they do is make money. It’s boring, but it’s dependable.” (Emphasis added.)

Read the rest of this piece at Robert Bryce Substack.

Robert Bryce is a Texas-based author, journalist, film producer, and podcaster. His articles have appeared in a myriad of publications including the Wall Street Journal, New York Times, Forbes, Time, Austin Chronicle, and Sydney Morning Herald.

Photo: Wikimedia in Public Domain (Government Work).