I’m on a panel about this tonight.

A unicorn is a privately owned startup company worth more than $1 billion.

Cool.

But what does that really mean in practice?

It means super fast growth.

What’s the opposite of that?

Stagnation.

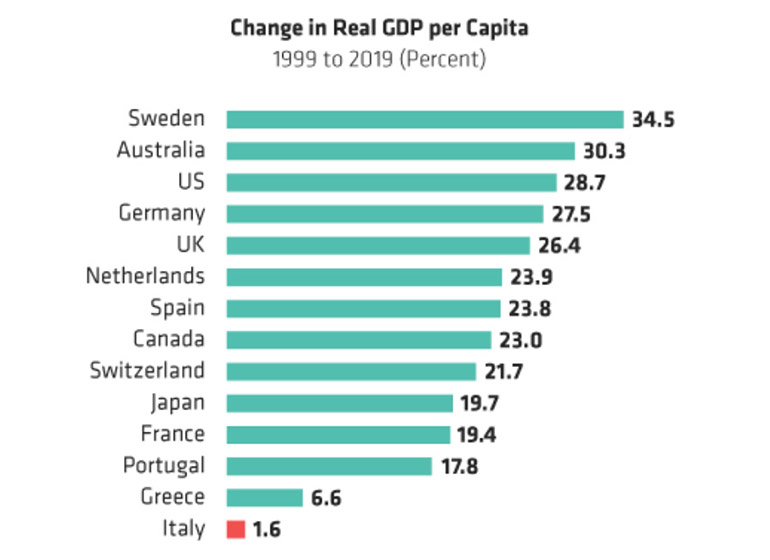

And what country has been stagnating in the last 30 years, the age of the unicorns?

Italy, you guessed that right.

There you go.

Why we have no unicorns. It’s really that simple. It’s really that complicated.

Take the opposite: how come China is full of recently founded companies that are now huge?

Well, if you have 1.3 billion people going from North Korea to California within a couple of generations, growing on average 10% per year… you will get lots of entrepreneurs quickly becoming very rich.

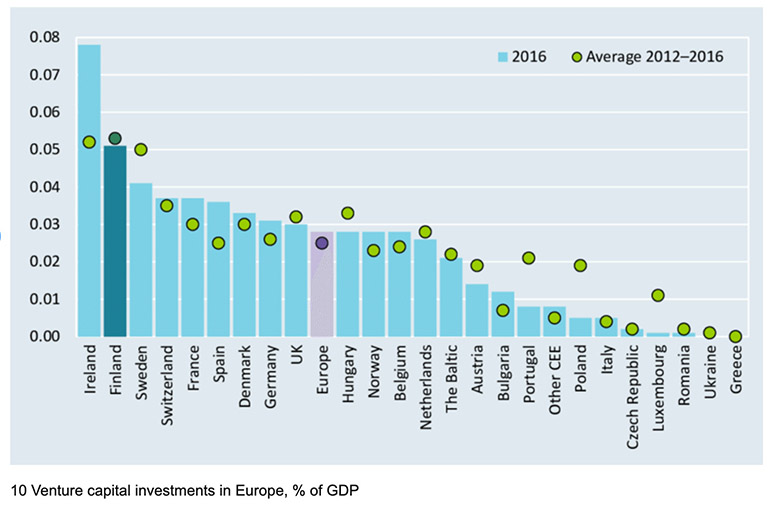

Low VC volumes are over-discussed

In my bubble, people focus a lot on the little amount of capital invested.

I used to say that it’s a symptom, not a cause.

In the end, capital is way more mobile than other assets, and if we had lots of great startups, foreign funds would move in.

Then I realized innovation is a complex system, and there is no scientific way to break down cause-effect relations. It’s all interlinked.

Sure, VC invested is a metric, but you can also argue that in the early stages, local capital matters a lot, and the risk aversion of our VC funds (and more upstream, of their LPs), does create problems.

Still, this is only one piece of the puzzle.

On a micro level, a good startup needs a kickass team and a growing market with an appetite for new solutions.

On the macro level, you have supply of and demand for innovation.

Read the rest of this piece at AndreaZorzetto Substack.

Andrea Zorzetto is Founder and President at Poliferie and Co-Founder and CEO of Peoplerank, a review platform of startup founders and investors for the Italian market.

Photo: Vincent van Zeijst, sculpture of unicorn with its foal, roaming in the courtyard of the Bernhoven Hospital in Uden (Netherlands), via Wikimedia under CC 4.0 License.