While much of the focus is on the Covid-19 pandemic, the geography of Europe’s knowledge intensive jobs is being reshaped. For the fifth year, the European Centre for Entrepreneurship and Policy Reform (ECEPR) has in collaboration with Nordic Capital, a leading Nordic private equity firm, mapped the locations of knowledge intensive jobs of Europe. The brain business jobs index examines jobs in four knowledge-intensive industries—the tech sector, information and communications technology (ICT), advanced services, and creative professions. More specifically, we measure what percentage of the working population in 31 European countries and 280 regions within those countries work in these “brain business jobs”. Our 2021 study finds significant shifts in the geographical distribution of Europe’s knowledge industries.

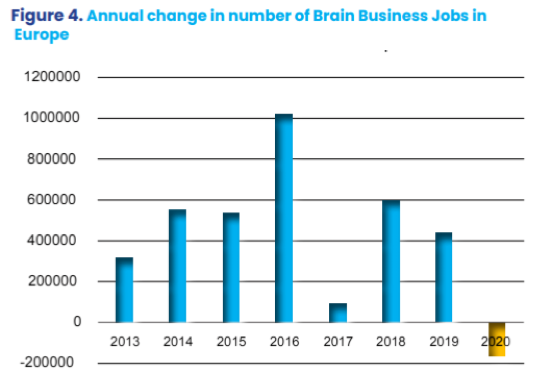

Before 2020, knowledge-intensive jobs were growing steadily in Europe. Between 2013 and 2019, on average 509 000 brain business jobs were added on a yearly basis, to the economies of the EU-member states plus the UK, Switzerland, Norway, and Iceland. In 2020 however, the number of brain business jobs fell for the first time, by nearly 167 000. The exception is the Nordic region, which added 8 600 brain business jobs during 2020, despite the global corona crisis. Most of the brain business job losses occurred in the tech-sector, in which 118 000 jobs were lost. In ICT close to 22 000 jobs were lost, compared to 15 000 in advanced services and 11 000 in creative professions.

We believe that the decline in 2020 will be followed up with a renewed boom for knowledge-intensive jobs. Then Europe will continue the path of geographical shifts of brain busines jobs. The share of Brain Business Jobs differs markedly across Europe. At one end of the spectrum are Switzerland, Sweden, and the Netherlands, in which between 9.0 to 10.4 percent of the working age population are employed in brain business jobs. On the other end of the spectrum is Romania and Greece where the same share is below 4 percent. The country ranking still follows a geographical division of Europe: with Northern and Western Europe at top and Southern, Central and Eastern Europe at bottom.

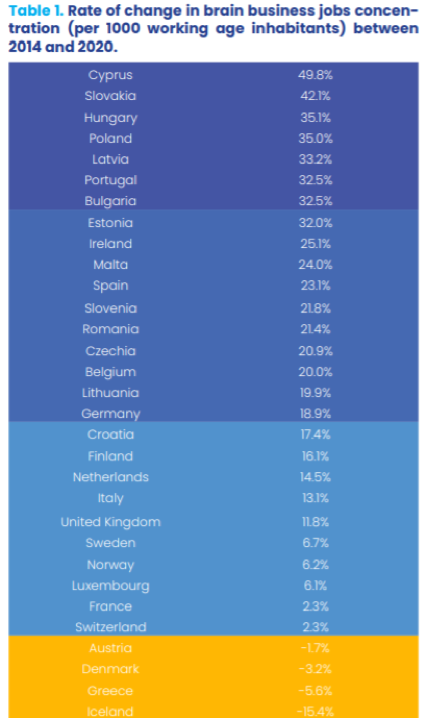

However, same as in previous years indexes, the data shows that significant changes in the geographical distribution is occurring. Despite the 2020 slum, the long-term trend is a rapid increase of the share of working age population of European nations that work in knowledge-intensive enterprises. The growth is particularly strong in the Eastern and Central European nations, and some Southern European nations. The two regions with lower brain business jobs concentration are thus gradually catching up to northern and western Europe, which have a higher concentration of knowledge-intensive jobs, but a slower rate of increase.

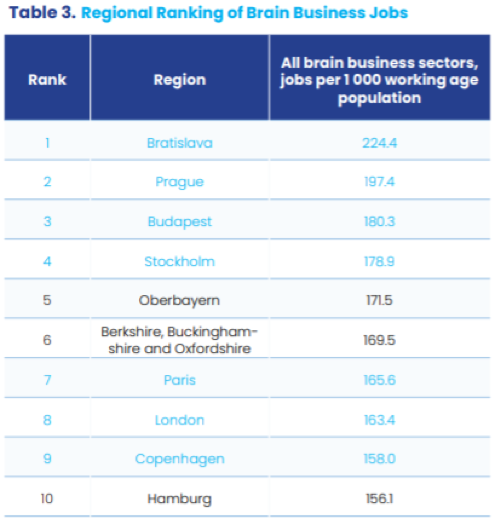

The capital regions of Central and Eastern European nations have some of the highest levels of brain business jobs concentration. The Slovakian capital region of Bratislava emerges as the number one region in Europe in terms of the concentration of brain business jobs – as it has also in previous editions of our index. Fully 22 percent of the working age population of the region is employed in knowledge-intensive businesses. The 2019 edition of the brain business jobs index found that Bratislava is also the region with the second highest rate of increase in knowledge-intensive jobs, which is also the finding in this year’s index. Bratislava is followed by the Czech capital region Prague in second place as the region with highest share of working age population employed in knowledge-intensive jobs. On third place is the Hungarian capital region Budapest, followed by Sweden’s capital region Stockholm, and the Oberbayern region in Germany.

Many amongst the new generation growing up in Central and Eastern Europe work hard to learn those skills which are in hot demand in the marketplace, such as programming and engineering. While the countries still have not reached the levels of Northern and Western Europe, their capital regions are becoming hotbeds for knowledge-intensive occupations—relying on an ample supply Bucharest ranks on 14th place in brain business jobs concentration amongst the European regions and has additionally strong growth performance. Romania and Poland are two examples of nations which lag in brain business jobs, but have strong increase over time, and particularly strong rate of growth in their respective capital regions.

On a regional basis, the most significant increase of brain business jobs has occurred in Warsaw, the Polish capital region, followed by the Slovakian capital region Bratislava, and the German region of Braunschweig. Braunschweig was an important centre of commerce already in medieval Germany and is one of several strongly growing German regions. Two other German regions, Mittelfranken and Karlsruhe, are also among the top-5 growing regions. Germany stands out in this comparison, as the country has many different strong brain business hubs. While Berlin is strong in terms of brain business jobs concentration, and growth of same, it is one among many hubs in the country.

Perhaps the main conclusion is that a fast equalization of knowledge jobs is occurring in Europe. Since 2014, Cyprus has experienced an almost 50 percent increase of brain business jobs per capita, while Slovakia, Hungary, Poland, Latvia, Portugal, and Bulgaria have experienced an increase of a third or more. Ireland is the Western European nation with the strongest rate of growth, with an increase of 25 percent since 2014. In Finland, the share of the working age population employed by knowledge-intensive enterprises has risen by 16 percent since 2014, the strongest growth rate in Northern Europe.

Among the largest European economies, Spain and Germany have a relatively good growth of brain business jobs over time, with the UK, France and Italy having a relatively slow pace of growth. The knowledge jobs are instead rapidly forming in numerous smaller European nations. This development is happening under the radar, at least for foreign observers who rarely focus on the development of smaller European economies such as Cyprus, Malta and Slovakia. Yet we believe that this development is indeed key for Europe’s progress and international competitiveness. Knowledge-jobs are growing throughout Europe, and knowledge-capital is increasingly flowing across borders. Numerous smaller European nations that before had limited knowledge-intensive sectors are flourishing and offering partnerships to European knowledge-regions such as the Nordics, Switzerland and the UK – where wages for talents are higher. Firms in top knowledge hubs such as Stockholm, Copenhagen, London and Zurich often cooperate with those in developing knowledge intensive hub such as Bratislava, Prague and Budapest. The result is reduced costs, and increased competitiveness. The result is both regional cooperation and institutional competition.

The Nordic countries for example are increasingly focused on market-oriented reforms, to boost firm competitiveness (contrary to the popular US myth of Nordic socialism), and even France is looking towards market reforms. The smaller growth countries already have relatively low taxes and are working towards creating more streamlined business regulation. The changing landscape of Europe’s brain business jobs is creating not only jobs and prosperity, but also an appetite for market reform. To fully understand what is happening in Europe, it is important for international observers to not only look at the few larger European economies, but also understand the important role played by smaller countries which already have strong knowledge sectors (Switzerland, the Nordics, Netherlands, Ireland, Estonia), and the myriad of smaller countries in Eastern and Southern Europe that have a strong growth of knowledge jobs over time. The smaller European nations play a key part in the changing landscape, boosting Europe’s entrepreneurial potential.

Download the full report here.

Read the rest of this piece at Foreign Policy.

Dr. Nima Sanandaji is the Director of European Centre for Policy Reform and Entrepreneurship (ECEPR). He has written more than a hundred policy papers on subjects ranging from integration and womens career progress to the changing geography of successful enterprise and the future of jobs. His work, which includes 18 books, has been quoted in media around the world and translated to several languages.

Klas Tikkanen is the chief operating officer of Nordic Capital. Previously, he was a management consultant with McKinsey & Company, followed 19 years working in senior management functions, mostly as a chief financial officer in private equity or bank-owned portfolio companies.

Photo by Laurens Derks via Unsplash.