The phrase, “Think Globally, Act Locally” has often been used by environmentalists to sum up a strategy devoted to conserving the earth's scarce natural resources at the local level. More recently, business executives borrowed the idea to emphasize the need for building capabilities at the country or regional level even as they pursue global growth. But now the Millennial Generation, Americans born between 1982 and 2003, are giving the phrase an entirely new meaning as they pursue their efforts to change the world – one local community at a time. read more »

Policy

ULI Moving Cooler Report: Greenhouse Gases, Exaggerations and Misdirections

Yesterday a group of environmental advocacy groups, foundations and other organizations released a report, Moving Cooler, amid much fanfare, seeking to have us believe that it is a serious study of GHG reduction options in the transportation sector. It is immensely disappointing. The world could use a dispassionate, objective and broad-based assessment of petroleum reduction options as well as their positive and negative consequences. This is not it. read more »

Salinas Dispatch: A Silver Lining in the Golden State

From a distance, a crisis often takes on ideological colorings. This is true in California, where the ongoing fiscal meltdown has devolved into a struggle between anti-tax conservatives and free-spending green leftist liberals.

Yet more nuances surface when you approach a crisis from the context of a specific place. Over the past two years my North Dakota-based consulting partner, Delore Zimmerman, and I have been working in Salinas, a farm community of 150,000, 10 miles inland from the Monterey coast and an hour's drive south of San Jose. read more »

UK Green Path leads to Deindustrialization and Worsening Housing Shortage

The First Secretary of State, Secretary of State for Business, Innovation and Skills, and Lord President of the Council, Peter Mandelson, together with Ed Miliband, the Secretary of State for Energy and Climate Change, have published The UK Low Carbon Industrial Strategy. They are claiming it promises an "economic revolution” but is in fact an environmentalist retreat from industrial production It is a disastrous strategy that will result in further de-industrialisation, supposedly with the aim of addressing a rather vague threat of climate change. read more »

- Login to post comments

Globalization Leads to Civic Leadership Culture Dominated by Real Estate Interests

"Cleveland’s leadership has no apparent theory of change. Overwhelmingly, the strategy is now driven by individual projects. These projects, pushed by the real estate interests that dominate the board of the Greater Cleveland Partnership, confuse real estate development with economic development. This leads to the 'Big Thing Theory' of economic development: Prosperity results from building one more big thing." read more »

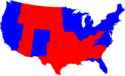

The Blue-State Meltdown and the Collapse of the Chicago Model

On the surface this should be the moment the Blue Man basks in glory. The most urbane president since John Kennedy sits in the White House. A San Francisco liberal runs the House of Representatives while the key committees are controlled by representatives of Boston, Manhattan, Beverly Hills, and the Bay Area—bastions of the gentry. read more »

The Next Culture War

The culture war over religion and values that dominated much of the last quarter of the 20th century has ended, mostly in a rout of the right-wing zealots who waged it.

Yet even as this old conflict has receded , a new culture war may be beginning. This one is being launched largely by the religious right's long-time secularist enemies who are now enjoying unprecedented influence over our national politics. read more »

Urban Backfill vs. Urban Infill

By Richard Reep

Wendell Cox recently reported on the state of so-called “urban infill” efforts, and analyzed which cities are experiencing an increase in their density. This report shows some surprising trends. Cities such as Pittsburgh, which claim to be successful at “infilling”, are actually dropping in density, in part because of low birth rates and lack of in-migration. read more »

Forcing Density in Australia's Suburbs

Australia is a continent sized country with total urbanized area of only 0.3%. As is the case with the USA, the population is increasing as a result of natural growth and immigration. The country is blessed with a sunny climate and enough space to enable its inhabitants to enjoy a relaxed, free lifestyle.

Given this, one would expect there would be little support for the higher density housing ideology of the Smart Growth advocates. Yet since the early 1990s the Australian Federal Department of Housing has been pushing exactly this approach. read more »

Subsidies, Starbucks and Highways: A Primer

At a recent Senate Banking Committee hearing, Senator Robert Menendez of New Jersey, responding to comments about large transit subsidies, remarked that the last federal highway bill included $200 billion in subsidies for highways.

The Senator should know better. The federal highway bill builds highways with fees paid by highway users, not by subsidies. read more »