NewGeography.com blogs

The new state (and DC) population estimates indicate a substantial slowdown in growth, from an annual rate of 0.93 percent during the 2000s to 0.75% between 2011 and 2012. This 20 percent slowdown in growth was driven by a reduction in the crude birth rate to the lowest point ever recorded in the United States (12.6 live births per 1000 population).

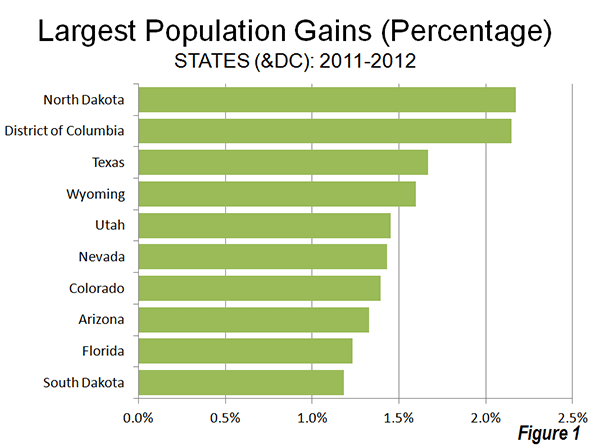

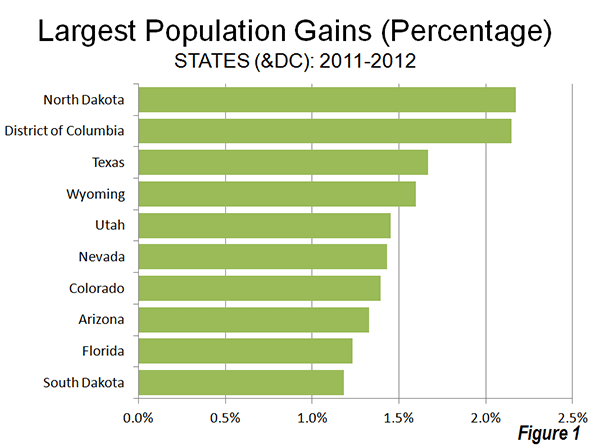

The big surprise was the population growth leader, North Dakota, which has experienced a strong boom in natural resource extraction. Between 1930 and 2010, North Dakota had lost population. However in the first two years of the new decade, North Dakota has experienced strong growth, and reached its population peak, according to the new estimates, in 2012. North Dakota's population growth rate between 2011 and 2012 was 2.17%. Nearby South Dakota also grew rapidly, ranking 10th in population growth. The other fastest-growing states were all in the South or the West. The District of Columbia, located in the strongly growing Washington, DC Metropolitan area ranked second in growth rate behind North Dakota (Figure 1).

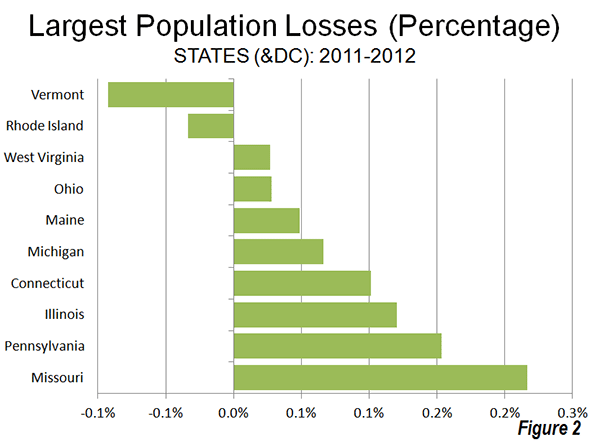

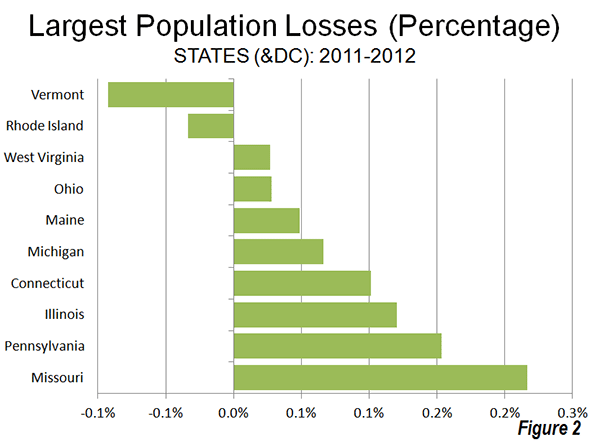

Two states lost population, Vermont and Rhode Island, as the Northeast and Midwest represented all but one of the 10 slowest growing states. West Virginia, in the South, was also included among the slowest growing states (Figure 2).

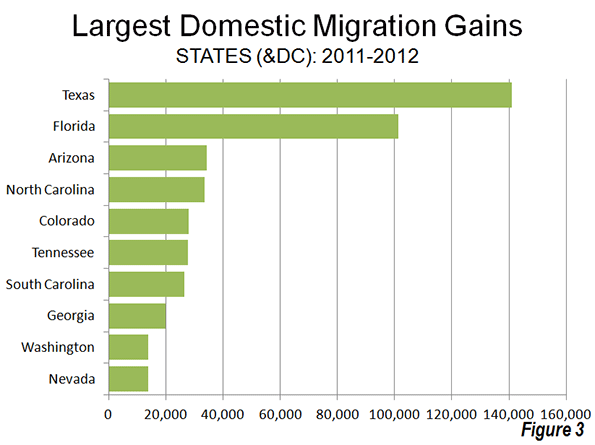

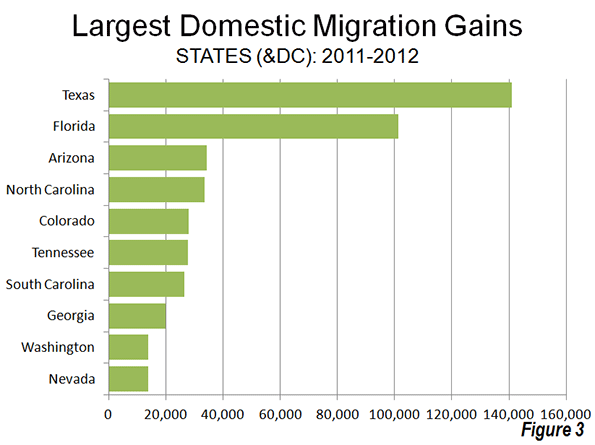

The domestic migration trends continue to favor the South and West. Texas continues to attract the largest number of domestic migrants (141,000), followed by Florida (101,000). These two states have been the domestic migration leaders in the nation every year since 2000 (Figure 3). Four states gained from 25,000 to 35,000 domestic migrants (Arizona, North Carolina, Tennessee and South Carolina).

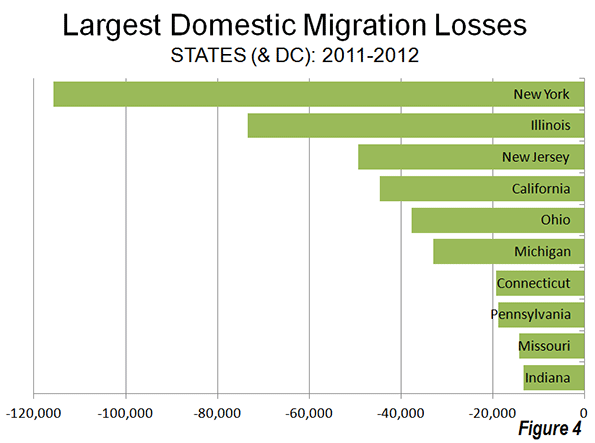

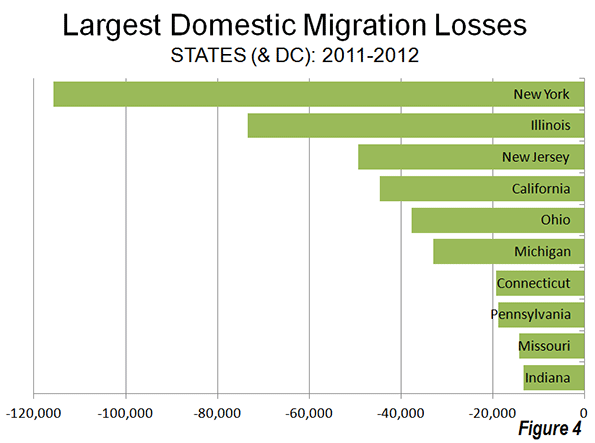

Generally, the same states continued to dominate domestic migration losses, with New York losing the most migrants, Illinois ranking second, followed by California, Ohio and Michigan. With the exception of California, all of the 10 states losing the largest number of domestic migrants were in the Northeast or the Midwest (Figure 4).

Overall, domestic migration continues to be dominated by the South, which attracted 354,000 residents from other states. The West added 52,000 domestic migrants, however virtually all of this gain occurred in the Intermountain West. Gains in Oregon and Washington were far more than offset by the large losses in California, as well as losses in Hawaii and Alaska. The Intermountain West gained more than 70,000 domestic migrants. The Northeast lost 221,000 domestic migrants, while the Midwest lost 185,000.

One of my lesser historical obsessions has been the grandiose stuff that's been proposed for the Los Angeles area and never built. Things like the amusement park that Walt Disney proposed for Burbank before he put Anaheim on the map with Disneyland, or the assorted hotels, parks, monorails and highways that were given ink in the newspapers but either fell through or were never that real to begin with. I've written before about the sketch on my office wall from a 1913 Los Angeles Times front page envisioning a future downtown of skyscrapers, high-altitude auto bridges and curiously a waterfront. Imagine how different the city would be if, for instance, Valley promoters had gotten their way to plant the original LAX due west of the corner of Balboa and Roscoe. Or if the 1930 plan from Olmsted and Bartholomew for a chain of parks and playgrounds across the city had been accomplished.

Sam Lubell, the West Coast Editor of the Architect’s Newspaper, and Greg Goldin, the architecture critic at Los Angeles Magazine, have mined the landscape and found some real gems. Lloyd Wright's incredibly grand 1925 Civic Center for downtown (above.) Or the 1952 master plan for LAX by architects Pereira and Luckman. The plan is to use the research to mount an ambitious exhibition next spring at the A+D Architecture and Design Museum on Wilshire. They have launched a Kickstarter campaign to make it happen, and of course you can help.

Check out their cool video:

This piece first appeared at LA Observed.

" The IRS should be applauded" --- it is hard to imagine a public statement to this effect, other than from a government insider. But this was the Tax Foundation, improbably and correctly complimenting the Internal Revenue Service in announcing that its annual income tax migration data would continue to be produced. This apparently reverses a decision to discontinue the data. The Tax Foundation noted that there was:

... outrage when the IRS announced that they were canceling the program. An IRS economist, informed of the decision by higher-ups, told the Daily Caller: "We were just told this morning that the program is indeed going to be discontinued. It is not our decision at all and we are very disappointed." Jim Pettit, of the activist group Change Maryland, penned a National Review piece noting that the decision came soon after the data put Maryland Governor Martin O'Malley on the defensive (O'Malley has routinely asserted that Maryland has a great tax system and business climate, despite strong evidence to the contrary), and the Washington Examiner followed up with an editorial saying that the data is vital for ascertaining which "model" of states (high-tax, high-service vs. low-tax, low-service) Americans were preferring. Members of Congress also started calling, demanding an explanation.

We join in the chorus. This data has been valuable for many uses and many will continue to use it in the years to come.

Has the finance industry trainjacked America?

By all accounts the Acela has been a success. Thought it is far from perfect and constitutes moderate speed rail for the most part, it seems to have attracted strong ridership. A midday train was totally packed on both the BOS-NYC leg and NYC-DC leg the last time I rode it. I didn’t see an empty seat anywhere. Which is pretty amazing given how much more expensive it is than the regional, and frankly not that much faster. It does seem to have accomplished its mission of more closely linking Boston, New York, and Washington.

The question is, is that actually a good thing? Or has the improved connectivity the Acela brings had unforeseen negative consequences? I believe you can make an argument that the Acela has actually helped birth the stranglehold the finance industry has over federal fiscal and monetary policies, and thus has hurt America.

I don’t have time to fully develop that here, but to anyone who has been following any of the many excellent sites tracking the financial crisis over the last few years, it is obvious.

There is now a near merger between Wall Street and K Street. During the financial crisis, the government and the Fed have kept Wall Street well supplied with bailouts and nearly free access to capital that allows them to literally print risk free profits by recycling in the free loans into interest bearing government debt, all while Main St. businesses and homeowners have borne the full brunt of a credit crunch, state and local governments fiscally starve, and infrastructure funds dry up. Finance industry insiders have now obtained a near lock on the position of Treasury Secretary. When a president like Bush dares to appoint someone with actual industrial experience, Wall Street’s displeasure is made manifest, and it generally succeeds in undermining him. New laws like Dodd-Frank strangle new entrants to the field while enshrining the privileged status of the too big to fail. The fact that it allows government to seize these “systematically important financial institutions” shows not the industry’s weakness but its strength, as big banks de facto function as instrumentalities of the state, but with profits privatized and losses socialized. Not a single major figure in the events causing the financial meltdowns has gone to jail or even been prosecuted (only a collection of ponzi schemers and insider traders who, despite their criminality, had no systematic impact – the crisis blew up their scams, their scams did not cause the crisis). The list goes on.

The geographic proximity of New York to Washington, with quick trips back and forth on the Acela, facilitates this. Clearly, you could get back and forth on the shuttle without it, but given the Acela’s popularity, it does seem to have some big benefits in shrinking the distance between New York and DC. I’d argue this has been unhealthy for America. If true high speed rail ever came to the NYC-DC corridor, who knows what might happen?

Perhaps you don’t agree and will feed me to the dogs for this post. But I think it’s very clear that transportation networks have vast impact on the structure of society, not just how people and goods get from Point A to Point B. The interstate highway system is proof of that. Indeed, advocates of high speed rail (and I’ve been a qualified one myself, supporting it clearly in the Northeast Corridor but being skeptical about most others) boast of the positive transformational effects of HSR as one of the reasons to build it. But as with the interstate highway system, we need to be aware of the hidden risks as well.

The Acela is perhaps living proof that high speed rail can reshape America. It is literally helping rewrite the geographic power map of America. Unfortunately, at this point don’t think that’s been a good thing.

This piece originally appeared at The Ubanophile.

The latest US Census Bureau migration data shows that people continue to move from principal cities (which include core cities) in metropolitan areas to what the Census Bureau characterizes as "suburbs" (Note). Between 2011 and 2012, a net 1.5 million people moved from principal cities to suburbs (principal cities lost 1.5 million people to the suburbs). The movement to the suburbs was pervasive. In each of the age categories, there was a net migration from the principal cities to the suburbs. There was also net migration to the "suburbs" in all categories of educational attainment.

These data are in contrast to claims that people are moving from a suburbs to central cities. Virtually none of the migration data has shown any such movement. Moreover, the city population estimates produced for 2011 by the Census Bureau, which indicated stronger central city growth have been shown to be simply allocations of growth within counties, rather than genuine estimates of population increase.

----

Note on Census Bureau "Suburbs:"

The movement to the suburbs is undoubtedly understated in the Census Bureau estimates, because many jurisdictions included in the "principal city" classification are in fact suburbs. The Real State of Metropolitan America showed that virtually all population growth in principal cities was either in suburban jurisdictions classified as principal cities, or in cities with substantial expenses of post-World War II automobile oriented (or suburban) land-use patterns. The remaining core cities that are largely only urban core in land use accounted for only 2% of principal city growth from 2000 to 2008.

For a decade, the Census Bureau has used a "principal city" designation instead of the former "central city" term. All former "central cities" are "principal cities." The Census Bureau characterizes all other areas of metropolitan areas as "suburbs." In fact, many of the principal cities are functionally suburbs, having barely existed or not existed at all at the beginning of the great automobile oriented suburban exodus following World War II.

Examples of such suburban principal cities, with their metropolitan areas in parentheses, are Hoffman Estates (Chicago), Arlington (Dallas-Fort Worth), Aurora (Denver), Fountain Valley (Los Angeles), Eden Prairie (Minneapolis-St. Paul), Mesa (Phoenix), Hillsboro (Portland), San Marcos (San Diego), Pleasanton (San Francisco), Kent (Seattle), Virginia Beach (Virginia Beach-Norfolk) and many others.

|