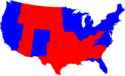

On the surface this should be the moment the Blue Man basks in glory. The most urbane president since John Kennedy sits in the White House. A San Francisco liberal runs the House of Representatives while the key committees are controlled by representatives of Boston, Manhattan, Beverly Hills, and the Bay Area—bastions of the gentry. read more »

Policy

The Next Culture War

The culture war over religion and values that dominated much of the last quarter of the 20th century has ended, mostly in a rout of the right-wing zealots who waged it.

Yet even as this old conflict has receded , a new culture war may be beginning. This one is being launched largely by the religious right's long-time secularist enemies who are now enjoying unprecedented influence over our national politics. read more »

Urban Backfill vs. Urban Infill

By Richard Reep

Wendell Cox recently reported on the state of so-called “urban infill” efforts, and analyzed which cities are experiencing an increase in their density. This report shows some surprising trends. Cities such as Pittsburgh, which claim to be successful at “infilling”, are actually dropping in density, in part because of low birth rates and lack of in-migration. read more »

Forcing Density in Australia's Suburbs

Australia is a continent sized country with total urbanized area of only 0.3%. As is the case with the USA, the population is increasing as a result of natural growth and immigration. The country is blessed with a sunny climate and enough space to enable its inhabitants to enjoy a relaxed, free lifestyle.

Given this, one would expect there would be little support for the higher density housing ideology of the Smart Growth advocates. Yet since the early 1990s the Australian Federal Department of Housing has been pushing exactly this approach. read more »

Subsidies, Starbucks and Highways: A Primer

At a recent Senate Banking Committee hearing, Senator Robert Menendez of New Jersey, responding to comments about large transit subsidies, remarked that the last federal highway bill included $200 billion in subsidies for highways.

The Senator should know better. The federal highway bill builds highways with fees paid by highway users, not by subsidies. read more »

Prince Charles is Britain's Master-eco-fraudster

Thomas Paine was born in Thetford, Norfolk, in 1737. He understood that history is made. Aged 39, writing his Common Sense, he noted that Britain is constituted of '...the base remains of two ancient tyrannies, compounded with some new republican materials.' These were:

'First. - The remains of monarchical tyranny in the person of the king

Secondly. - The remains of aristocratical tyranny in the persons of the peers.

Thirdly. - The new republican materials, in the persons of the commons, on whose virtue depends the freedom of England.' (1) read more »

Enviro-wimps: L.A.'s Big Green Groups Get Comfy, Leaving the Street Fighting to the Little Guys

So far, 2009 has not been a banner year for greens in Los Angeles. As the area's mainstream enviros buddy up with self-described green politicians and deep-pocketed land speculators and unions who have seemingly joined the “sustainability” cause, an odd thing is happening: Environmentalists are turning into servants for more powerful, politically-connected masters. read more »

Why Rapid Transit Needs To Get Personal

Innovation in urban transportation is the only long-term correction for expensive environmental losses and energy waste. Why, then, isn’t there a US plan for more vigorous exploration and demonstration of new systems using advanced technologies, particularly automation? Where is the Personal Rapid Transit — PRT — in US transportation policy? read more »

Telecommuting And The Broadband Superhighway

The internet has become part of our nation’s mass transit system: It is a vehicle many people can use, all at once, to get to work, medical appointments, schools, libraries and elsewhere.

Telecommuting is one means of travel the country can no longer afford to sideline. The nation’s next transportation funding legislation must promote the telecommuting option...aggressively. read more »

Who Killed California's Economy?

Right now California's economy is moribund, and the prospects for a quick turnaround are not good. Unable to pay its bills, the state is issuing IOUs; its once strong credit rating has collapsed. The state that once boasted the seventh-largest gross domestic product in the world is looking less like a celebrated global innovator and more like a fiscal basket case along the lines of Argentina or Latvia.

It took some amazing incompetence to toss this best-endowed of places down into the dustbin of history. Yet conventional wisdom views the crisis largely as a legacy of Proposition 13, which in effect capped only taxes.

This lets too many malefactors off the hook. I covered the Proposition 13 campaign for the Washington Post and examined its aftermath up close. It passed because California was running huge surpluses at the time, even as soaring property taxes were driving people from their homes. read more »