Housing affordability has been a tenacious and intractable urban problem for as long as stats have been kept. Several cities recently declared it a crisis. But what kind of problem is it? Opinions vary widely. An economic problem, or a social one? A land resource issue? Or, as traded wisdom would have it, the result of reliance on the wrong urban form? Proposed solutions vary accordingly. Now, new evidence rules out one potential source of unaffordable housing: clearly, it is not an urban form problem. The widely-believed theory that a city's lack of affordable housing can be fixed with increased compactness — when combined with public transit — is apparently wrong.

In a recent article we questioned a publicized correlation between a compactness index level (i.e., urban form) and housing affordability. The argument supporting compactness is that it enables the use of public transit and active mobility modes, which reduce transport expenses sufficiently to eclipse the higher cost of housing prevalent in compact districts. We challenged that assumption, and found that data from eighteen US regional metro regions showed no such effect. Even if it were at all present, it would not be sufficiently pronounced to be an effective solution. Those conclusions were based on a regional look at the problem.

While the aggregate regional data undermined the urban form theory of affordability, what do sub-regional level data show? At this finer level, could the housing-plus-transportation burden work to the advantage of households? To answer this question, we used data from 18 districts of the Metro Vancouver (BC) region. In this case, the official data exclude certain types of households — a critical limitation. But, given that such disaggregated data are rare, an effort at deciphering their meaning is warranted.

The two subject groups were Working Homeowners and Working Renters. First, we looked at whether or not the working homeowners could find accommodation that suited their income without stretching themselves thin.

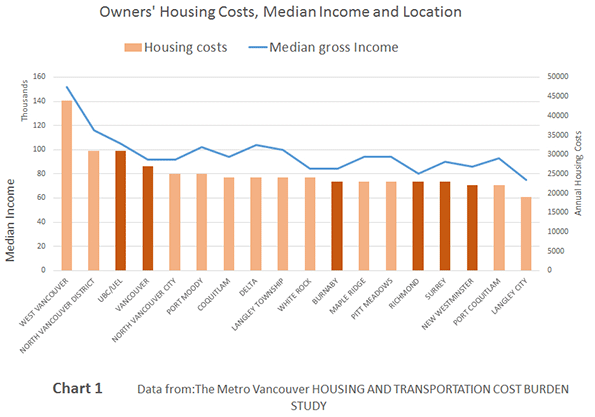

Chart #1 shows the progression of housing costs in each sub-regional district, and the corresponding household median income. The in-step slopes of the two data sets suggest that working home-owning households have housing costs in tune with their earnings. This implication is further confirmed by the strong correlation (R2= 0.8598) between their income and their housing expenses.

Housing costs that are proportional with income are a positive sign, but can these homeowners actually make their mortgage payments without financial stress? The data says yes, they can. This group's average ratio of housing payments to income is 26%. It never exceeds 30%, the accepted threshold of financial strain.

Instructively, from an urban form perspective, the highest ratios occur in the central, compact district; a confirmatory finding. Equally expected are that the lowest cost-to-income ratios occur in districts furthest from the center; these districts are either suburban or exurban.

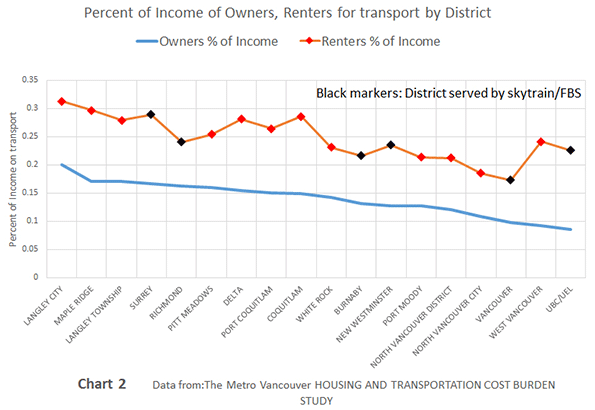

But are any of these home-owning households disadvantaged by excessive transportation costs due to their location? The data show a normal, average transportation expense of 14% of income and a range from about 8% to 20%. The ratios do increase with distance, but bear no significant correlation with income (R2= 0.0178).

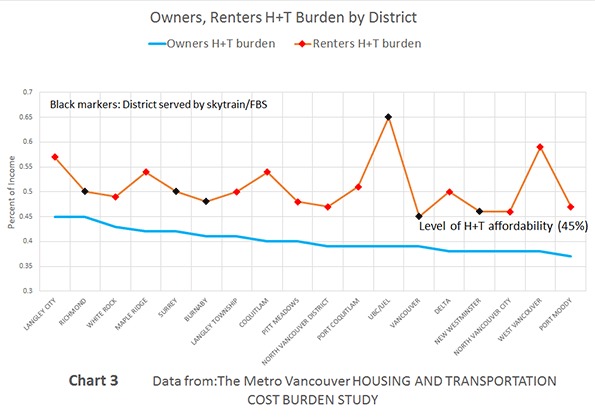

When choosing the place of residence, do homeowners consider housing costs, but disregard transportation costs? If so, could this lead to an affordability problem as measured by the combined costs? Apparently not. Chart #3 graphs (blue line) this group’s cost burden for combined housing and transportation (H+T) expenses, which never exceed the recognized affordability threshold: 45% of income.

Conclusion? Metro Vancouver's 305,000 households of working homeowners with mortgages aren't experiencing financial strain due to their housing costs, no matter what their preferred housing form, location or transportation arrangements. The urban and suburban locations of the city structure fully satisfy their housing and transport needs. Neither compactness nor its absence has a negative impact on their finances.

The data paints an entirely different picture for the 224,000 working households that rent their accommodations. Their average H+T burden (Chart #3; orange line) is 51% of their median income, and it ranges from the 45% threshold of affordability to an extreme of 65%.

This picture, however, is not the result of high housing costs; rents register in the affordable range in all locations but two. The average working renter's housing cost is 26%, which mimics that of a homeowner, and the range is below the stress level of 30%, with only two outliers (out of 18 districts) at 35% and 45% of income. For renters, as is the case for homeowners, the highest housing costs occur in the more compact districts. The outliers are found in elite social cluster districts — highly desirable neighborhoods — entirely unrelated to urban form.

Given that rent costs are within the affordable range in all but two locations, we may infer that the Metro Region provides a sufficient range of housing costs for this group in its current urban/suburban structure.

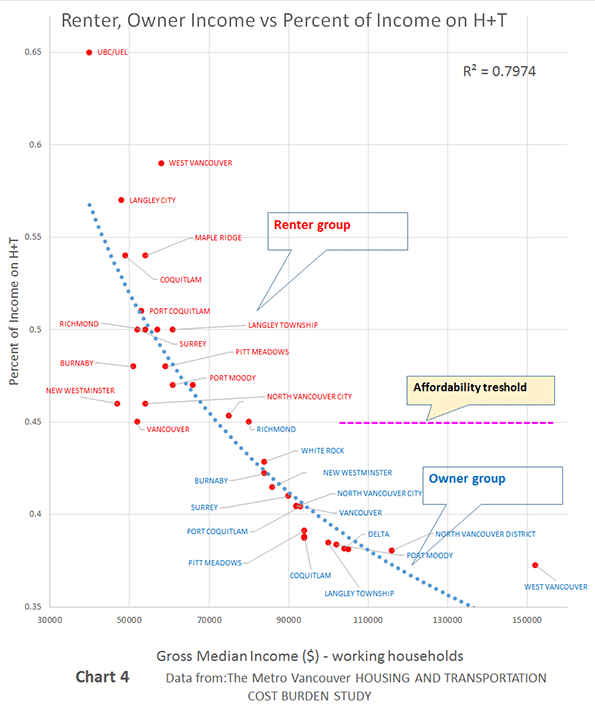

These findings are reinforced by the proportionality of incomes and housing expenses for both homeowners and renters. The incomes of renter households range from 45% to 63% of homeowners by location, and their rent costs are from 45% to 65%, an almost identical range.

It would seem, then, that the excessive H+T burden renters face can be attributed partially to the transportation costs of this group. However, contrary to expectations, of the six districts that have rapid rail service (sky-train; black markers on Chart #3), not one manages to have a total burden below the affordability threshold. That even goes for the two suburban districts that offer the lowest rents.

Chart #4 clearly shows the division between the earnings of owners and renters, and the affordability threshold that separates them. The belief that a compact urban form provides a path to solving housing affordability problems appears untenable.

Overall, the data shows that for working homeowners there are no locations in the Metro Vancouver Region, whether urban, suburban or exurban, that push housing costs or the combined costs of housing and transportation above the affordability threshold. Urban form is not affecting budgets in these households.

For working renters, rents are affordable in 16 of the 18 districts, whether urban, suburban or exurban. However, when transportation costs are added to their housing costs, the new sum puts them in financial stress, even in districts served by rapid rail transit.

This sub-regional, limited analysis confirms the findings of our earlier regional look: compactness and access to transit do not produce the affordability benefits that have been claimed. The compact urban form does not equal more affordable living, particularly for the less affluent.

Fanis Grammenos heads Urban Pattern Associates (UPA), a planning consultancy. UPA researches and promotes sustainable planning practices including the implementation of the Fused Grid, a new urban network model. He is a regular columnist for the Canadian Home Builder magazine, and author of Remaking the City Street Grid: A model for urban and suburban development. Reach him at fanis.grammenos at gmail.com.

Flickr photo by Nick Kenrick: The Neighbourhood of East Van

Critical Review of This Analysis

Readers of this blog may be interested in my new Planetizen column, "An Accurate Answer to an Interesting Question: Are Compact Neighborhoods Really Most Affordable?" (http://www.planetizen.com/node/86539) which points out some biases and omissions in its analysis.

Grammenos assumes that it is appropriate to directly compare homeowner and renter cost burdens, which ignores a critical difference: "legacy" households that purchased homes many years ago have relatively low mortgage payments due to inflation and rising incomes. Ignoring this factor makes homeownership seem more affordable compared renters, and understates financial stresses to many recent and current home buyers. In other words, Grammenos uses backward-looking data although most housing affordability discussions, and the H+T affordability analyses he criticizes, are forward-looking, designed to reflect the trade-offs facing current home buyers.

Grammenos finds little correlation between rapid transit service availability, indicated by a district containing a SkyTrain station, and affordability, and so concludes that "access to transit do not produce the affordability benefits that have been claimed." This is based on the wrong geographic scale. Although districts such as Surrey, Richmond, and Burnaby contain SkyTrain stations, they are overall automobile-dependent suburbs. To accurately measure public transit affordability impacts it is necessary to measure transportation expenditures in the transit-oriented neighborhoods close to these stations. In fact, a recent study did find substantially lower vehicle ownership rates, and therefore transportation costs, around SkyTrain stations compared with otherwise comparable households located further away.

Contrary to Grammenos's claims, his analysis actually indicates that for lower-income households (indicted by renters), housing and transportation affordability increases significantly as districts become more compact and multi-modal. Look at the dots with red labels in his Chart 4; these show that the portion of renter household’s budgets devoted to housing and transport is lowest in the city of Vancouver (45 percent), slightly higher in the adjacent suburb of North Vancouver (46 percent), significantly higher in outer suburbs such as Richmond, Burnaby, and Surrey (48-50 percent), and highest in exurban districts such as Coquitlam, Maple Ridge, Langley, and West Vancouver (54-58 percent). Outliers, such as Pitt Meadows and Port Moody, are exurban areas with small populations, and UBC/UEL, a university district with many low-income students.

The data presented do not justify Grammenos' conclusions the Metro Vancouver Region is affordable for home buyers and that urban form does not affect household budgets. At most he could reasonably conclude that compact development does not reduce higher-income household's housing and transport cost burdens, but even that statement should acknowledge that the data are biased by older, legacy households and so do not apply to recent or future house buyers, many of whom could benefit overall by choosing homes in more compact, multi-modal neighborhoods with lower transportation costs.

I appreciate feedback and welcome comments on the Planetizen website where my full critique is posted.

=====================================================

Todd Litman is founder and executive director of the Victoria Transport Policy Institute (www.vtpi.org), an independent research organization dedicated to developing innovative solutions to transport problems.