Nothing is perhaps more pathetic than the exertions of economic developers and politicians grasping at straws, particularly during hard times. Over the past decade, we have turned from one panacea to another, from the onset of the information age to the creative class to the boom in biotech, nanotech and now the "green economy." read more »

Financial Crisis

“Cash For Clunkers” Doesn’t Utilize Junkyard Efficiency

My father owned and operated a junkyard in Tucson for a number of years, and I learned a lot about the auto recycling industry helping around the office and as a delivery driver. So as a junkyard enthusiast, the “Cash For Clunkers” program naturally caught my interest lately. Though it looks to be the product of good intentions, I don’t think the legislation understands that junkyards already comprise an efficient, well developed recycling system for salvaging vehicles, with a beneficial result for the environment overall. read more »

Forget Second Stimulus; We Need Economic Vision

As the American economy slowly heals, the Obama administration will no doubt claim some credit for its $787 billion stimulus — and perhaps even suggest doubling down for a second stage. Republicans, for their part, will place their emphasis on the “slow” part of the equation and persistent high unemployment, blaming the very same stimulus program.

Whatever the politics, no new stimulus should be considered unless it deals with the fundamental illness undermining the country’s long-term economic prospects. Such a stimulus would address the country’s essential problem: persistent overconsumption amid underproduction. read more »

The Dollar: Running on Reserve

During the recent financial crisis, I didn’t meet anyone else who was invested in stocks and bonds. I guess I was the only one. Everyone else was holding “cash,” as they often quietly boasted. But even if your money is kept under a mattress, cash is best understood as a zero-coupon bond, in most cases drawn against an overdrawn nation-state.

Cash may be king, but the sovereign looks more temporary than a Romanov heir living in a rented villa in the south of France. read more »

Follow the Money: Special Inspector General for the Bailout

The House Committee on Oversight and Government Reform held a critically important hearing on July 21 titled "Following the Money: Report of the Special Inspector General for the Troubled Asset Relief Program (SIGTARP)." Sadly the mainstream media under reported the meeting. read more »

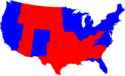

The Blue-State Meltdown and the Collapse of the Chicago Model

On the surface this should be the moment the Blue Man basks in glory. The most urbane president since John Kennedy sits in the White House. A San Francisco liberal runs the House of Representatives while the key committees are controlled by representatives of Boston, Manhattan, Beverly Hills, and the Bay Area—bastions of the gentry. read more »

The Next Global Financial Crisis: Public Debt

The cloud of the global financial meltdown has not even cleared, yet another crisis of massive proportions looms on the horizon: global sovereign (public) debt.

This crisis, like so many others, has its root in the free flow of credit from the preceding economic boom years. The market prices of assets were rising steadily. Rising valuations, especially where they were based on improving revenues from robust economic activity, led to rising income streams for governments. This encouraged governments to borrow more, perhaps often to expand services – and the bureaucracy required to offer services – although sometimes to improve infrastructure. read more »

Tracking Business Services: Best And Worst Cities For High-Paying Jobs

Media coverage of America's best jobs usually focuses on blue-collar sectors, like manufacturing, or elite ones, such as finance or technology. But if you're seeking high-wage employment, your best bet lies in the massive "business and professional services" sector.

This unsung division of the economy is basically a mirror of any and all productive industry. It includes everything from human resources and administration to technical and scientific positions, as well as accounting, legal and architectural firms. read more »

Washington, DC: The Real Winner in this Recession

No matter how far the economy falters, there is always a winner. And no city does better when the nation is at the brink of disaster than Washington, DC. Since December 2007, when the current recession formally began, the nation has lost approximately 6 million jobs. Only two states, Alaska and North Dakota, have lost a smaller percentage of jobs than Washington, DC, which has seen a job loss of 0.6%, or 4,400. Simply put, Washington has done better in this recession than 48 of the fifty states when it comes to job performance. read more »

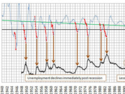

Recession Analysis: When will the job market fully recover?

No one knows this answer for sure, but the data show some interesting trends for what's possible. This analysis takes two approaches to answer this question, including:

- Total employment: suggests recovery in 2012

- Employment growth rates: suggests recovery in mid-2010 ... but ...

This is a work in progress. Tomorrow the future will change.

Current status read more »